Average Directional Index ADX: Definition and Formula

Contents

When we trade in the direction of a strong trend, it reduces risk and also increases our profit potential. J. Welles Wilder’s Direction Movement Index comprises three lines – the ADX Line, PDI Line, and NDI Line. The ADX indicates the strength of the price trend while the Positive and Negative Directional Indicators measure the uptrend and downtrend. The goal of ADX is to show you where the market is heading so that you can move in the same direction.

Alternatively, when the -DI crosses past the +DI line, and the ADX reading is above 20, then they may see this as an excellent opportunity to sell and go short . The Average Directional Index is a popular indicator for measuring the strength of a trend. The series of ADX peaks are also a visual representation of overall trend momentum. ADX clearly indicates when the trend is gaining or losing momentum. A series of higher ADX peaks means trend momentum is increasing.

Due to the fact that the ADX is a trend strength indicator, it is best suited to trade the long term trends. Some indicators that can complement the use of the ADX indicator include Bollinger bands, Donchian channels, Keltner channels and so on. If price is below its moving average, then the markets are in a downtrend. Of course, you should also look at the ADX at this point to validate that the DI- is above the DI+. Next, watch the Stochastics oscillator to signal an overbought condition. This can typically occur when the price is posting a correction to the downtrend.

The trend might be your friend, but it sure helps to know your other friends, too. The Average Directional Index, or ADX, is a trend indicator that is used to quantify the strength of a trend. It is plotted as a single line with a value between 0 and 100.

Therefore, when trading atrending strategy, favor long positions when the +DI is above the -DI line. These indicators can be used in conjunction with the ADX to further filter or confirmtrade signals. As a general rule, traders and investors know that detecting and trading in the direction of solid trends is a good strategy with minimal risk exposure. It has become one of the most popular indicators among traders of all levels for this reason. In terms of function, it can identify the prevailing conditions in the market.

Pros and cons of using the ADX indicator

It signifies that the buying has overcome the selling when the price crosses the line. The MACD oscillator is one of the most popular and widespread oscillators. Still, in our case, it only matters whether the histogram is above or below zero since the histogram acts as a filter to open signals. An upward trend indicates an upward trend, and a downward trend shows a downward trend.

- The strength of the trend is seen by the ADX line itself.

- ADX Crossing 25 from Below indicates that the stock is in trending phase whereas ADX Crossing 25 from Above indicates that the stock is in consolidation phase.

- On the other hand, when the –DI crosses from below the +DI and the ADX is above 25, you can consider it a good moment to go short.

- It is used in trending markets to indicate trend strength .

- Earlier in this article, we discussed how you can open positions as the DM lines cross one another and the ADX is at a certain threshold.

The higher the price movement, the higher the +DM value. Cory Mitchell, CMT is the founder of TradeThatSwing.com. He has been a professional day and swing trader since 2005. Cory is an expert on stock, forex and futures price action trading strategies. The ADX indicator can be applied to any markets, but it is recommended that you pick markets where trends are maintained for a prolonged period of time. The ADX indicator can also be applied across any time frame of your choice, making this a versatile technical trading indicator that you can use.

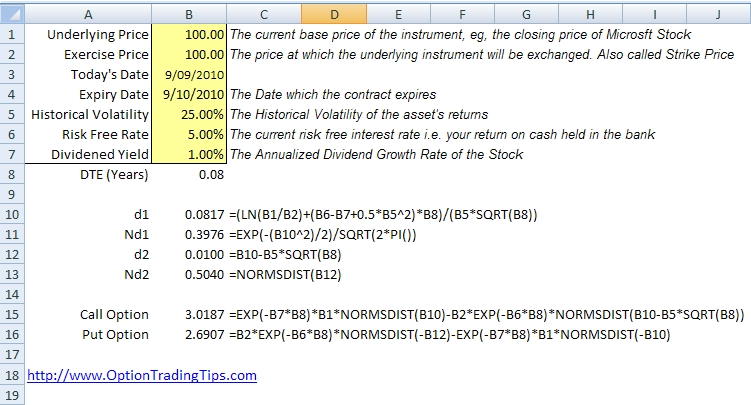

Average Directional Index Formula

ADX Crossing 25 from Below indicates that the stock is in trending phase whereas ADX Crossing 25 from Above indicates that the stock is in consolidation phase. The ADX is an indicator that allows you to understand the strength of a trend. Using it, you can decide whether to move with a trend or not. However, you should know that ADX is a lagging indicator.

Calculate the ADX for a set of 14 values with the formula (DX1 + DX2 +…+DX14) / 14. He allows the trend to breathe a little while he goes and makes his coffee. As soon as he’s back, the ADX value begins to rise further. Average Directional IndexThe https://1investing.in/ second session of the commodity market begins and Mr. Av Raj notices that there’s something different about Crude Oil futures. Once the ADX value retracts from its highs, you may want to reconsider your position because the trend is tapering off.

SE Blog- What is Narrow Range Scans?

ADX values using only 30 periods of historical data will not match ADX values using 150 periods of historical data. ADX values with 150 days or more of data will remain consistent. He’s a non-directional commodity trader who relies on the ADX to help him analyze securities. Once the ADX value rises from its lows, the market is considered to be moving toward a strong trend.

Beginning in January though, ADX started to climb above 50, signaling that a strong trend could be waiting in the wings. It is based on comparing the highs and lows of bars and does not use the close of the bar. When trading, it can be helpful to gauge the strength of a trend, regardless of its direction. Determine significant support and resistance levels with the help of pivot points. The DI+, is usually depicted with a green color, while the DI- is depicted by the red color. When the DI+ is above the DI- line, it indicates that the general trend is to the upside.

Like any indicator, the ADX should be combined with price analysis and potentially other indicators to help filter signals and control risk. Crossovers can occur frequently, sometimes too frequently, resulting in confusion and potentially lost money on trades that quickly go the other way. The stronger the trend, the larger the reading regardless of whether it is an uptrend or downtrend.

Solana price prediction for November 30, 2022

Sophisticated software that scans through all the charts, on all time frames and analyzes every potential breakout, with high accuracy. The signals occur rarely, but they are average directional index strategy high probability trades. The trade was fueled by a long term trend line breakout. This move came when the ADX was above 20, so we were safe to enter short on the market.

It was developed by Welles Wilder, the famous trader who also developed other indicators like the Average True Range , Parabolic SAR, and the Relative Strength Index . He created the indicator with commodities in mind but traders can use it well across other assets like commodities, currencies, and stocks. Technical analysis is one of the two most-common strategies that Wall Street traders use to forecast the direction of an asset. The process is so useful such that it is now used to create expert advisors or algorithms that are responsible for a substantial part of the global market. However, like any other technical indicator, the ADX can’t provide 100% accurate signals all the time.

Once we know the direction we intend to trade, we need to spot a breakout of a support or resistance, to be confirmed by the ADX. Add the ADX indicator, calculated for the last 100 period. We will use a higher period for calculating the ADX because we want to eliminate market noise as much as possible.

But before that directional movement must be calculated to find +DM and -DM. Calculating the ADX is based on a moving average of the price range expansion for a certain period of time. Alternatively, it is the average of the directional index values over the specified period.