- By Kire Arsovski

- In Bookkeeping

What is a Control Account?

Content

VAT Liability This is the default account used when you transfer balances from the VAT on sales and VAT on purchases control accounts, this routine is completed at the end of a VAT period. This is the amount of VAT you owe to the tax authorities or the amount you are due as a refund. Tax control accounts are used to define tax types, and tax types are used to define tax codes. Tax codes in your transaction records determine how much tax is applied to each line item on your transactions. Administratively, organizations normally create divisions or sections in their accounting/finance department commonly referred to as accounts receivable and payable sections.

What is a bank control account?

Control accounts are general ledger accounts in your Chart of Accounts that are used to reconcile your general ledger with your clients/matters. For example, a trust bank account is a control account.

At last, you can make a controlingl account by putting ending balances of subsidiary accounts. So, it will tell you total collections and total receivables you owe from your customers. The types of control accounts include debtors control accounts, creditors control accounts, and stock control accounts.

Accounting Topics

To do so, we get accumulated balances that affect the movement of accounts. For instance, Accounts payable is effected by credit purchases, payment made to the supplier, purchase returns, and discounts received. Ledger AccountsLedger in accounting records and processes a firm’s financial data, taken from journal entries.

Other examples of controlling accounts and their subsidiary ledgers include “accounts payable” and “equipment” . Control accounts provide a high-level picture of a company’s transaction records.

Control account for accounts payables (reconciliation perspective)

Within the Earned Value Management System the control account is the basic building block of the project management process. It is the control point where technical scope, schedule, and cost parameters are integrated. The control account is also the point where work progress is measured, where actual costs are collected, where variance analysis occurs, and where corrective action is initiated. The selection of the proper level of detail for the control account is a key factor in the success of the system application. Is a single manager within the organizational structure who has been given the authority and responsibility to manage one or more control accounts. Discount Allowed; this is financial relief extended to the customer/buyer to prompt quick payment of the debt.

At the end of each month, balance brought down is always extracted which becomes the opening balance brought down in the proceeding month. In contrast, your Petty Cash general ledger account is not a control account. Funds unrelated to specific clients/matters flow through your Petty Cash account, and because they are unrelated to clients/matters, you record these transactions using the Journal Entries program. When you enter a trust receipt, the program automatically updates both the client/matter and the trust bank general ledger account. The balance in the trust bank general ledger account must always agree with the total trust funds on your clients/matters, for that bank account.

EVMS Education CenterControl Account Manager (CAM)

They ensure that the accounts always balance and they are the default accounts to be used in a variety of circumstances. Some users may prefer to see the balance due at any point in time. In this case, you need only one account that would consolidate https://www.bookstime.com/ all your VAT or GST entries. A bill of exchange is a negotiable instrument which is a source of short term financing for an organization. It is prepared by the business to its customer asking him/her to acknowledge the debt due.

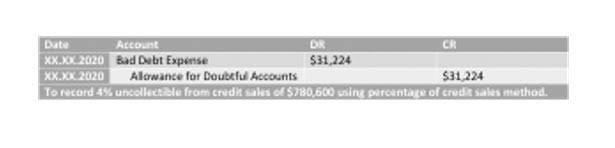

A Control Account is mainly used in larger corporations that have hundreds of transactions, and it is also part of double-entry accounting. However, it is an account that consists of the total amount of transactions that are stored individually within the subsidiary accounts. A control account is a summary-level account in the general ledger. This account contains aggregated totals for transactions that are individually stored in subsidiary-level ledger accounts. The ending balance in a control account should match the ending total for the related subsidiary ledger. If the balance does not match, it is possible that a journal entry was made to the control account that was not also made in the subsidiary ledger.

Purpose

If an accounting clerk is tasked with entering purchase transactions, another person may be made responsible for the control account, protecting against fraud. Since this is the total of one’s debtors, and debtors are assets, it normally has a debit balance. This account records the value of tax from subcontractors’ payments before the money is included on the CIS monthly return .

- It serves the purpose of the reconciliation that increases our confidence in the ending balance of accounts receivables.

- This account records the value of the tax deductions from subcontracts’ payments, once the monies have been included in the CIS monthly return and are ready to be paid to HMRC.

- Part C where you said sales ledger control account means creditors control.

- To provide totals of debtors and creditors quickly when a trial balance is being prepared.

- Try it now It only takes a few minutes to setup and you can cancel any time.

- Because control accounts summarize information in subsidiary ledgers, they should always remain in balance.