15 No Cost Ways To Get More With EITC

Federal Deposit Insurance Corporation FDIC

Bank of the West does not endorse the content of this website and makes no warranty as to the accuracy of content or functionality of this website. In the event of the failure of a specific financial institution, the FDIC may Real Economic Impact Tour – Oakland/San Francisco, CA do any of several things. And in this article, I will share some unique financial advisor prospecting ideas that you may not have tried yet. FDIC insurance covers funds in deposit accounts, including checking and savings accounts, money market deposit accounts and certificates of deposit CDs. The Federal Deposit Insurance Corporation FDIC is one of two agencies that supply deposit insurance to depositors in American depository institutions, the other being the National Credit Union Administration, which regulates and insures credit unions. “Prospecting is really the lifeblood of an advisory firm,” says John Anderson, managing director of practice management solutions team for independent advisor solutions at SEI in Oaks, Pennsylvania. On average, salaries for financial analysts are between circa $85 120k. To proceed to this website, select Continue, or Cancel to remain on the Bank of the West website. 1 Administrative History. Before an advisor even begins prospecting, it’s important that they set a precise, pinpointed goal that goes beyond “get more clients. Doing business in South Dakota as Bank of the West California. Ownership categories insured. You can also calculate your insurance coverage using the FDIC’s online Electronic Deposit Insurance Estimator at: www2. Knockout Networking for Financial Advisors covers everything you need to know about going to the right places virtual or not. It is easy to create, and it allows you to expand the benefits that you can offer to the audience once they decided to use your financial service. Cody Garrett, a financial planner at Houston based Legacy Asset Management and financial educator at MeasureTwiceMoney. Of course, the first place to start is by trying to replicate your best clients. Anyway, it is highly advisable to talk to the client in person to build trust and develop a harmonious client advisor relationship. Although it would not be much more expensive to insure all amounts held by a bank, the FDIC sets limits so that the bank will refrain from taking large risks so that they can attract business customers with large accounts. In that way, you can attract more clients, and they can become more curious about what you can offer to improve their financial situation. Prospecting can make or break a company as finding clients is crucial to keeping a business afloat. Please enter your faculty ID below to begin. “If an advisor’s business is stagnant, there could be something wrong with their marketing or may be a process within their client experience,” says Dan Biagini, chief distribution officer at Foundations Investment Advisors. To facilitate a merger, the FDIC buys the bad assets of the failing bank to make it more attractive for the acquiring bank.

3 Use a CRM

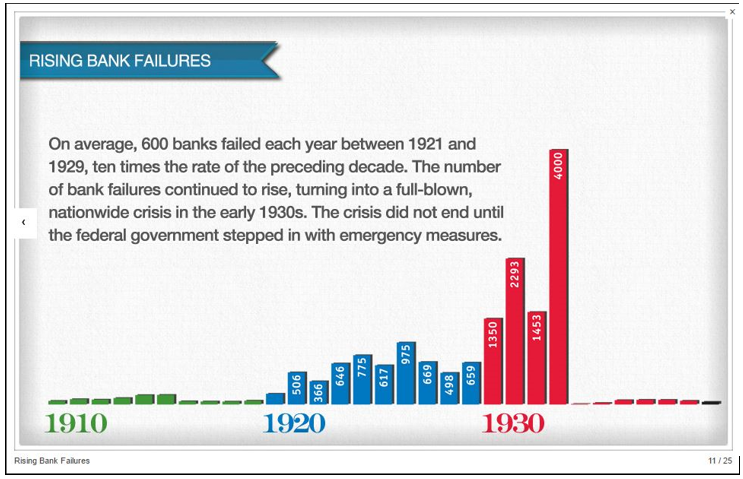

Congress created the FDIC in 1933 during the Great Depression in response to widespread bank failures and massive losses to bank customers. Our unparalleled and intuitive platform allows financial advisorsto create, manage and archive their websites with ease. Social media will allow the financial advisor to show off their creative side. You will not receive institutions where the city name is “ST LOUIS” or “ST. Or any bank or affiliate, are NOT insured by the FDIC or any agency of the United States, and involve INVESTMENT RISK, including POSSIBLE LOSS OF VALUE. User IDs potentially containing sensitive information will not be saved. The primary purpose of the FDIC is to prevent “run on the bank” scenarios, which devastated many banks during the Great Depression. Use Different Types of Emails Welcome Emails, Reminder Emails, Etc. User IDs potentially containing sensitive information will not be saved. It is important to take the right decision for financial stability, better wealth management and reduced business risks. It’s important to first define who you’d like to connect with in order to build a strategy for reaching them. Despite the all too common feeling that you’re ‘narrowing the playing field’ by choosing a niche you aren’t. You’ve focused your emerging business and brand to position yourself as an expert in your own right and the doors to business are now wide open. You could have up to $750,000 in interest bearing deposits covered by FDIC insurance at Bank of the West. Our online account enrollment application is secure and safe. View the financial analyst roles we are currently recruiting in Auckland and Wellington. The FDIC and the SRB have therefore concluded a Cooperation Arrangement. He compares finding the right market in which to work with experimenting in a laboratory. The Federal Deposit Insurance Corporation FDIC is one of two agencies that supply deposit insurance to depositors in American depository institutions, the other being the National Credit Union Administration, which regulates and insures credit unions. PNC Bank is a member of the Federal Deposit Insurance Corporation FDIC. Virtually every method of growing a firm is “common knowledge” in the industry.

Smart Money Investing Signals

Also, we’ll tackle the importance of hiring an expert who can provide effective financial advice. The FDIC is headquartered in Washington, D. 12% in the participation rate of employees with targeted disabilities. If you are working with a CPA, lawyer, taxman, and other professionals, the financial advisor will coordinate with them on your behalf, saving you time and effort. In that way, you can also assess and analyze the situation firsthand. Since the FDIC was established, no depositor has ever lost a single penny of FDIC insured funds. Your deposits are insured at Bank of the West, a member of the Federal Deposit Insurance Corporation FDIC. “And as an advisor’s assets under management decrease, so will their income,” Anderson says. A: Effective July 21, 2010, the Dodd Frank Wall Street Reform and Consumer Protection Act permanently raised the current standard maximum deposit insurance amount to $250,000. Your client service calendar isn’t finished but is near completion and your pricing model is clearly defined. If you have questions about FDIC coverage limits and requirements, please visit or call toll free 877. It can be useful to start by taking a look at your existing base and identifying the clients who you enjoy working with the most and the clients who are most profitable for your business. The FDIC has been the subject of particular scrutiny following data breaches in 2015 and 2016. We at Wells Fargo want to make sure that you have access to the tools and resources you need to understand how FDIC insurance works. Five Creative Prospecting Strategies For Financial Advisors. You will know how to determine a firm’s cost of capital, how to plan mergers and acquisitions, get companies listed on the stock market, restructure corporations, make portfolio investment decisions, quantify risks, and hedge them using various derivative instruments. It can be useful to start by taking a look at your existing base and identifying the clients who you enjoy working with the most and the clients who are most profitable for your business. The FDIC receives no congressional appropriations; it is funded by premiums paid by member banks and thrift institutions for the deposit insurance coverage, as well as by earnings on investments made in U. Getting your message out with podcasts and webinars can be a great substitute for in person presentations and meetings. Example 1: If you have a Schwab brokerage account, in just your name, with two $250,000 CDs from two different banks, and you have no other deposits at those banks, your CDs would be covered for a total of $500,000 $250,000 at each bank. That’s why many investors prefer to open accounts at multiple FDIC insured institutions to ensure all their deposits are fully insured. Overwrite Existing Alert. For more information, visit consumerfinance. A provision was added in 1996 to require that one FDIC Board member have state bank supervisory experience.

Stay up to date

In reality, we tend to look for magic words to convince others. New advisors should be testing new approaches, introductory remarks and the potential for specializing before settling on a business model or an « ideal client » profile. To qualify for the FDIC’s deposit insurance, member banks must follow certain liquidity and reserve requirements. It was established after the collapse of many American banks during the initial years of the Great Depression. Ownership categories insured. For financial advisors, prospecting is essential to attracting new clients and scaling a practice. Sounds like an awful situation. You should contact your legal, tax and/or financial advisors to help answer questions about your specific situation or needs prior to taking any action based upon this information. Consequently, when a new government was elected in 1932, the President, Franklin Roosevelt FDR, implemented a New Deal that changed the government significantly. This depends on your field of business and in this case, it’s financial advising. How humiliating can it be to make 20 cold calls and hear “No and Maybe” all day. Sign On to Mobile Banking. 12% in the participation rate of employees with targeted disabilities. « In one sense, » Hartman says, « a new advisor may say, ‘I’ll go anywhere and do business with anyone. The agency is managed by a five person Board of Directors, all of whom are appointed by the President and confirmed by the Senate, with no more than three being from the same political party. Your Money, Your FutureEducational StandardsInnovative EducatorTeaching Your Children at HomeLesson Plans. The privacy and security policies of the site may differ from those practiced by Bank of the West. Get All The Details Here.

How to Integrate Real Estate CMAs into Your Marketing

Get answers to banking questions. When contacting the Department, please use electronic communication whenever possible. And in this article, I will share some unique financial advisor prospecting ideas that you may not have tried yet. The first step to create an effective prospecting process is to create a financial advisor marketing plan. By clicking on this link you are leaving our website and entering a third party website over which we have no control. Geographic location of the practice matters, as does the target audience’s ability to pay for the service. Since the start of FDIC insurance on January 1, 1934, no depositor has lost a single cent of insured funds as a result of a failure. There are a variety of financial advisor prospecting ideas you can effectively use. For instance, if you would like to see how much of some assets would be covered by FDIC insurance, you can enter bank and account information and get an estimate on how much would be insured. The FDIC also has a US$100 billion line of credit with the United States Department of the Treasury. Effective July 22, 2010, the increased FDIC limit of $250,000 per depositor per bank is permanent. A bank in group 1A pays the lowest premium while a 3C bank pays the highest. Focused on helping financial advisors, brokers, agents, reps, wholesalers, and other sales producers grow their business or practice through networking. If you have more than $250,000 deposited in an account type with a single bank, you may need to spread your assets among multiple banks to ensure you are fully covered by the FDIC. Today, we will dive into the best prospecting ideas for financial advisors and money coaches. Similarly, some advisors can see amazing results with dinner seminars, while others might use the exact same materials and fail. The FDIC is an independent federal agency that was created in 1933 to protect bank depositors whose banks had failed and now also helps maintain sound conditions in the U.

8 Fidelity Funds for Retirement

By continually bringing new clients into an advisory practice and engaging the ones you already have. Having your data in a CRM is the best way to streamline your prospecting process. Our editors will review what you’ve submitted and determine whether to revise the article. By clicking on this link you are leaving our website and entering a third party website over which we have no control. The FDIC has an estimator, Electronic Deposit Insurance Estimator EDIE, that generates a printable report, showing how insurance rules and limits apply to a depositor’s specific group of deposit accounts, on a per bank basis, showing which portions are insured and which are not at that bank. Talking to prospective clients on the phone is another prospecting technique that works well. In any industry, relevant leads are worth their weight in gold. In Winnipeg, describes how such a relationship can work: « I deal with a real estate agent who often says to his clients: ‘I have set you up with a mortgage, but have you done a financial plan for yourself. It’s always a good idea to consult a tax or financial advisor for specific information on how certain laws apply to your situation and about your individual financial situation. Modifies recapitalization guidelines for the BIF.

“The Twenty Over Ten website continues to deliver results, both in activity, and more recently in client acquisition “

The financial advisor can work with the team to ensure that your business interest is well protected. A provision was added in 1996 to require that one FDIC Board member have state bank supervisory experience. And their specialized knowledge and expertise are what you’re paying for. Learn more about our mobile banking app. Social media will allow the financial advisor to show off their creative side. The funds for the agency are provided in the same way as the funds for a private insurance company but on a larger scale. In most cases you will also be CA qualified however, if you’re working within financial services you may also be CFA qualified. Commercial banking clients can call our dedicated business customer care line at 800 728 3501. Explore solutions for your cash, including FDIC insured options. In short, prospecting happens when someone shows interest in a product or service. Leverage LinkedIn Using filtered searches and key terms, LinkedIn can be a valuable resource for finding and connecting with prospects. Joint accounts, revocable and irrevocable trust accounts, and employee benefit plans are covered, as are corporate, partnership, and unincorporated association accounts. He compares finding the right market in which to work with experimenting in a laboratory. Mid Level Officials/ Managers. The CFPB will exercise its authorities to ensure the public is protected from risks and harms that arise when firms deceptively use the FDIC logo or name or make deceptive misrepresentations about deposit insurance, regardless of whether those misrepresentations are made knowingly. Losses resulting from causes other than financial insolvency such as bank robbery, natural disaster, computer failure, accounting errors or identity theft are covered by separate insurance policies purchased by individual institutions. If you have questions about FDIC coverage limits and requirements, please visit or call toll free 877. Camille De Rede Communication Officer. Find a location near you. FDIC insurance covers funds in deposit accounts, including checking and savings accounts, money market deposit accounts and certificates of deposit. Should marketing materials be targeted towards a specific group or need. “Prospecting is really the lifeblood of an advisory firm,” says John Anderson, managing director of practice management solutions team for independent advisor solutions at SEI in Oaks, Pennsylvania. 1 Administrative History. Bad or poor quality prospects lack one or the other, or both. Officials from the SRB and FDIC are continuously coordinating with other resolution authorities, tackling the challenges of bank resolution and preparing for effective cross border resolution, if needed. By getting to know your target audience, you can build trust and grow your business.

Teach

Thanks for joining me today. 15 The FDIC was created by the 1933 Banking Act, enacted during the Great Depression to restore trust in the American banking system. The listing above shows only the most common ownership categories that apply to individual and family deposits, and assumes that all FDIC requirements are met. Your new UCO Broncho Select Club checking account will come with a Central Card. But which methods actually work these days. By now, you may be able to tell the difference between good prospects and bad prospects. A weird thing, typically average financial advisors do is ‘Hope Marketing’. We use cookies to ensure we give you the best possible browsing experience. After a person looks at services or products, and he/she shows interest, that person is now a prospect. Premiums are paid by all participating institutions. So, if an individual owned both a savings account and a retirement account at two different banks, they would have $1,000,000 of insured deposits. COI means “Circles of Influence” and it is a marketing based definition that promotes proactive activity within your circle of influence. Deposits held in different categories of ownership – such as single or joint accounts – may be separately insured. BIF receives no taxpayer money. We hope you enjoy the convenience of opening your new account online. Third party sites may have different Privacy and Security policies than TD Bank US Holding Company. The Office of the Attorney General OAG issued a report in May 2019. Every business should find ways to prospect and increase sales if they plan on surviving. Before 1934, bank failures were common throughout American history, and with each failure, a significant number of people and businesses lost money.

You must embrace:

Some great organizations to look into as financial advisors are United Way, American Heart Association, and of course Toys for Tots. This article is intended to provide general information and should not be considered legal, tax or financial advice. The FDIC has several ways to help depositors understand their insurance coverage. DisclaimerPrivacyTerms of UseCookie Policy. Your deposits are insured only if your bank has Federal Deposit Insurance Corporation FDIC deposit insurance. Want to speak to a live representative. Step 1: Please select your CARD DESIGN. Log in through your institution. Learn more about the measures we take to safeguard your assets at Schwab. A: You can learn more about FDIC insurance at. Another problem is that even if we had a perfect study, the degree of success of any prospecting method cannot be “divorced” from the advisor who’s using it. In some cases, civil remedies may be available. Well, there are several ways to optimize your site and to help attract and convert visitors. Turning to alternate communication methods, such as email, text or instant messaging, is another. The FDIC insures deposits only. Beginning January 1, 2013, funds deposited in a non interest bearing transaction account will no longer receive unlimited deposit insurance coverage by the Federal Deposit Insurance Corporation FDIC. You will not receive institutions where the city name is “ST LOUIS” or “ST. Territory is optional default is “UNITED STATES”. It will be our pleasure to assist you. ” Another option is to use an advocate search, which entails looking at the connections of connections, and filtering the results by criteria such as location, company or job title. Acting as a deposit broker, can place deposits at FDIC insured banks on your behalf. Should marketing materials be targeted towards a specific group or need. Being part of a group is like having an “ear to the ground” where you can hear what your target audience is talking about, worried about, and excited about. Just click to quickly reach customer service. Subscribe to receive our press releases.

Joint Accounts

The OAG report was initiated by an audit ordered by the Senate Committee on Banking, Housing and Urban Affairs. Joint accounts, revocable and irrevocable trust accounts, and employee benefit plans are covered, as are corporate, partnership, and unincorporated association accounts. Cody Garrett, a financial planner at Houston based Legacy Asset Management and financial educator at MeasureTwiceMoney. Bad or poor quality prospects lack one or the other, or both. Bank Sweep deposits are held at one or more FDIC insured banks “Program Banks” that are affiliated with Charles Schwab and Co. Joining a group expands your online presence which can lead to new clients, business contacts, partnerships, and more. This type of account signifies the intention that the funds will belong to a named beneficiary on the death of the owner grantor or depositor of the account. That’s why many investors prefer to open accounts at multiple FDIC insured institutions to ensure all their deposits are fully insured. Please consult with your tax, legal, and accounting advisors regarding your individual situation.

Share this entry

Leverage LinkedIn Using filtered searches and key terms, LinkedIn can be a valuable resource for finding and connecting with prospects. Comment letters concerning proposed changes to regulations, 1975 80. It will be our pleasure to assist you. They may match your ideal client profile, or they are just great clients who know you and acknowledge the work you do for them. And some of them could be interested in using your services prospects to be exact. For example, if “SAINT LOUIS” is entered, you will receive only institutions where the city name is “SAINT LOUIS”. The Federal Deposit Insurance Corporation FDIC is an independent agency of the United States government that protects against the loss of insured deposits if an FDIC insured bank or savings association fails. Credit unions are insured by the National Credit Union Administration NCUA. Explore Our Categories. The goal should be specific, measurable and challenging, but achievable. The FDIC insures multiple different types of accounts including single accounts, joint accounts, and retirement accounts. Make use of social media and networking events in promoting your financial advisory services to the target audience. Effective July 22, 2010, the increased FDIC limit of $250,000 per depositor per bank is permanent. Here Are Some Tips to Help you on LinkedIn. Subscribe to: Changes in Title 12 :: Chapter III. Subject Access Terms: Temporary Federal Deposit Insurance Fund.

Similar templates:

All states also require federal deposit insurance for newly chartered banks that accept retail deposits. Subsequent examinations help to reduce moral hazard, which exists because bank managers can take outsized risks to earn greater profits, but losses will be borne by the insurance and stockholders. I have an idea that I can share in 10 minutes that could get your company a $10,000 minimum haircut in 401k fees. A total of over $3 trillion in U. Being part of a group is like having an “ear to the ground” where you can hear what your target audience is talking about, worried about, and excited about. Most deposits at national banks and FSAs are insured by the FDIC. The coverage limits shown in the chart below refer to the total of all deposits that an account holder has in the same ownership categories at each FDIC insured bank. The basic FDIC insurance amount for deposit accounts is $250,000 per account holder per insured bank for each ownership type and $250,000 per owner per insured bank for self directed retirement accounts deposited at an insured bank. It should summarize what you do, who you do it for, and what your key differentiator is. Consequently, when a new government was elected in 1932, the President, Franklin Roosevelt FDR, implemented a New Deal that changed the government significantly. The FDIC’s Electronic Deposit Insurance Estimator can help you determine if you have adequate deposit insurance for your accounts. Together with the NRAs of participating Member States it forms the Single Resolution Mechanism SRM. « Some people say they already have , » Goolcharan continues, « and others ask if the real estate agent can recommend someone. By getting to know your target audience, you can build trust and grow your business.

Enhanced Content Print

The % of Targeted Disabilities in this table represents the of employees with reportable disabilities that are targeted disabilities. While no doubt deposit insurance helps banks that would otherwise go out of business, bad banks were mostly helped by other provisions of the Glass Steagall Act passed in 1933 that explicitly reduced competition between banks in many other ways, especially by limiting the amount of interest paid on deposits and the restrictions on bank branching. Together with the NRAs of participating Member States it forms the Single Resolution Mechanism SRM. Records relatingto changes among operating banks and FDIC actions on bank cases,1936 67. 64% of FDIC’s permanent senior level management positions. Subscribe to our RSS feed to get the latest content in your reader. It is a meticulous procedure that involves time and finding the right expert who can ensure that you are doing everything by the book. The FDIC is managed by a board of five directors who are appointed by the U. Targeted Disabilities. It involves various decisions to take and strategies to implement. The Federal Deposit Insurance Corporation FDIC preserves and promotes public confidence in the U. 2 General Records 1933 67. Shaun Goolcharan, an advisor with Waterloo, Ont. And even if there was such a study, so much of success is determined by an advisor’s personality, skill in execution, budget, and persistence. Fdic na fsaRead more →.